Eight out of ten homeowners uncertain about their home’s true value with two-thirds missing out on potential gains by wildly under-valuing their property

The data, which compared seller expectations with actual estate agent valuations, found that two-thirds of homeowners tend to undervalue their homes, missing out on potential gains

A third of homeowners who undervalued their property did so by £100,000 or more, leading to an unexpected windfall when they did sell

Those who have owned their home for 30 years or more are more likely to have an accurate idea of its value (31 per cent)

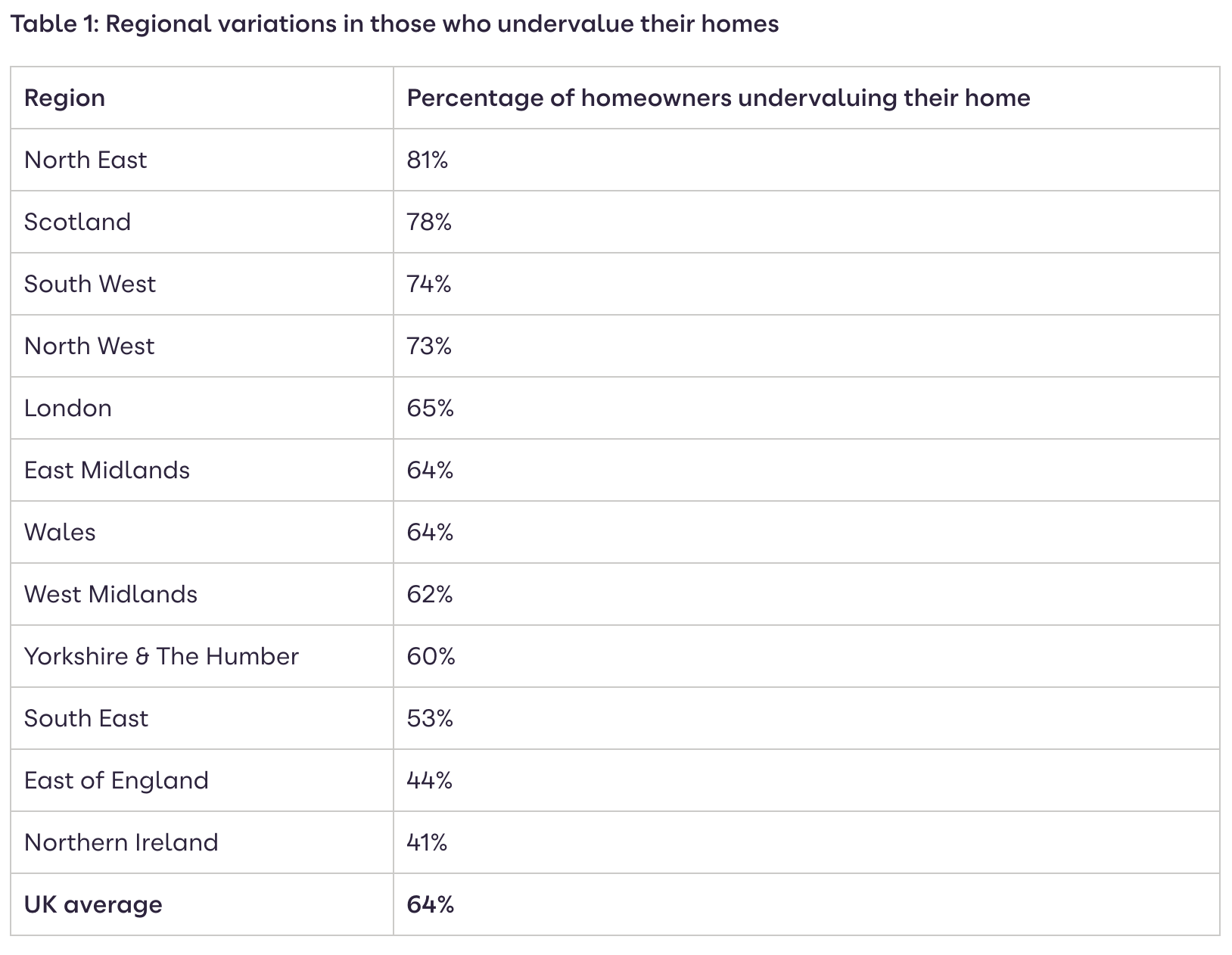

Homeowners in the north of the country are more likely to undervalue their homes, with 81 per cent of homeowners in the North East doing so, compared to 53 per cent in the South East

Amongst those who disagreed with their estate agent, just 16 per cent achieved what they thought their home was worth and took 60 per cent longer to secure an offer than those who undervalued their home

London: Eight in ten (78 per cent) homeowners do not have a clear idea of how much their property is worth(1), according to new research from Zoopla, one of the UK’s leading property websites. This is despite it being their biggest asset and the easy accessibility of accurate valuations online.

Homeowners missing out on potential gains by undervaluing their homes

House prices have remained relatively stable over the past two to three years which has led to some homeowners overvaluing their property. However, longer-term rises over the past decade mean that most property owners (64 per cent) still undervalue their home, with many having far more equity than they realised and missing out on potential gains.

The majority of homeowners who undervalued their property did so by between £10,000-£20,000 (15 per cent) or £20,000-£30,000 (13 per cent). However, more than a third (35 per cent) undervalued their home by £100,000 or more and nearly a fifth (18 per cent) did so by a huge quarter of a million pounds or more, leading to an unexpected windfall for those who went on to sell.

When questioned as to what increased their home’s value throughout their ownership, 33 per cent highlighted that the area had become more desirable and the same proportion (33 per cent) said that work they had completed on the property had added value. Furthermore, 29 per cent said that demand had increased for the type of property they owned.

Those who have owned their home for 30 years or more are more likely to have an accurate idea of its value (31 per cent), compared to the wider average of 22 per cent. This group tends to be more aware of fluctuations in house prices, checking the value of their property an average of four times a year.

Homeowners in the north of the UK are more likely to undervalue their properties

There is also a significant regional variation when it comes to homeowners undervaluing their homes, with 81 per cent of those in the North East saying that their home was worth more than they expected. Scottish homeowners are also highly likely to undervalue their homes, with 78 per cent doing so, followed by those in the South West at 74 per cent.

At the other end of the scale, those in Northern Ireland are the least likely to undervalue their properties, perhaps taking advantage of the 7.2 per cent year-on-year increase in house prices reported in Zoopla’s latest House Price Index(2). Homeowners in the East of England follow, with just 44 per cent undervaluing their homes.

Source: Zoopla

Some sellers still setting unrealistic price expectations

For others, their home's valuation has left them less happy, with 13 per cent finding that their estate agent's valuation was less than they hoped, on average by a very significant £46,866.

When asked why they had overvalued their property, nearly half (49 per cent) said that they assumed property prices had increased more than they had. Meanwhile, a quarter (25 per cent) said work completed on the property didn’t add as much value as expected and 13 per cent highlighted that the type of property they owned was less in demand.

Receiving less money than expected in the sale of their homes impacted 70 per cent of those who overvalued their property, most commonly leading to them having to stretch themselves financially to afford their next home (25 per cent). In addition, 14 per cent said they would have less money than expected for their retirement and 14 per cent said they had to cut wider spending to account for the shortfall.

Amongst those whose home was worth less than they thought and went on to sell, three in ten (28 per cent) said they had disagreements with the estate agent on the asking price and instead insisted the property was listed for what they believed it was worth.

Of them, just 16 per cent achieved their asking price. Instead, 74 per cent accepted a lower offer or reduced the asking price to make a sale. This meant that it took an average 60 per cent longer for their home to go under offer compared to for those who undervalued their home (45 days vs 28 days). Over one in ten (11 per cent) said they didn’t get a sale at all.

Daniel Copley, Consumer Expert at Zoopla, comments: “For most people, homes are their most valuable asset and most homeowners will need the money in future, whether that is to fund their next home or to free up money for retirement. It's therefore surprising to see how few have a clear idea of their property’s value and are missing out on potential gains when selling their homes. It’s even more surprising when you consider how easy it is to get a quick and accurate valuation online on websites such as Zoopla.

“While for most it is good news and their home is worth more than anticipated, a significant number have not realised that the house price boom has slowed down and they are overvaluing their property. This can lead to issues agreeing on an asking price with estate agents. But as the data shows, those who go against estate agents’ guidance rarely get what they hope for, highlighting that going with their guidance is the best way to get a reasonably quick offer and secure a sale.“

What locations do Carpenter Surveyors cover for surveys and valuations?

Areas we cover:

Warwickshire, Worcestershire, West Midlands, Staffordshire, Leicestershire, Rutland, Nottinghamshire, Derby, Gloucestershire, Herefordshire, Cotswolds and Northamptonshire.

Get a Quote from Carpenter Surveyors today.