House Price Index: November 2023

Homes are selling for £18,000 below asking price as the number of properties for sale reaches a six-year high. Zoopla’s House Price Index for November 2023 dives into the latest housing trends and what it means for next year.

Remember if you need a trusted Chartered Surveyor for your next move, be sure to arrange a quote with Carpenter Surveyors.

Key takeaways

The average house price in the UK is £264,600 with property prices falling by 1.2% compared to a year ago

Property sales are holding up despite weaker demand for homes, while number of homes for sale reaches six-year high

Discounts to asking price average 5.5% or £18,000 - the highest in 5 years - and are even larger in the South of England

London’s newfound value for money is supporting sales and pricing in the capital

House prices will continue to fall in 2024 but market activity could pick up if mortgage rates come down

Track the value of your home and compare it with other house prices in your area

The housing market continues to adjust to higher mortgage rates, shown in fewer sales and widespread (but modest) house price falls.

People selling their homes are steadily becoming more realistic and agreeing to larger discounts. There seems to be a growing acceptance that what a home was worth a year ago is now little more than a memory.

There are many more homes on the market than in recent years, putting more price pressure on those selling. This is felt most for 3 and 4+ bedroom homes which have had the greatest supply increase.

Zoopla expect a relatively strong number of residential property sales for 2024 and house prices will continue to fall slowly.

Property sales holding up despite weak demand for homes

Zoopla’s research team measure buyer demand in the number of enquiries to estate agents for homes listed for sale on Zoopla. This dropped over the summer as mortgage rates increased, before picking up again in autumn.

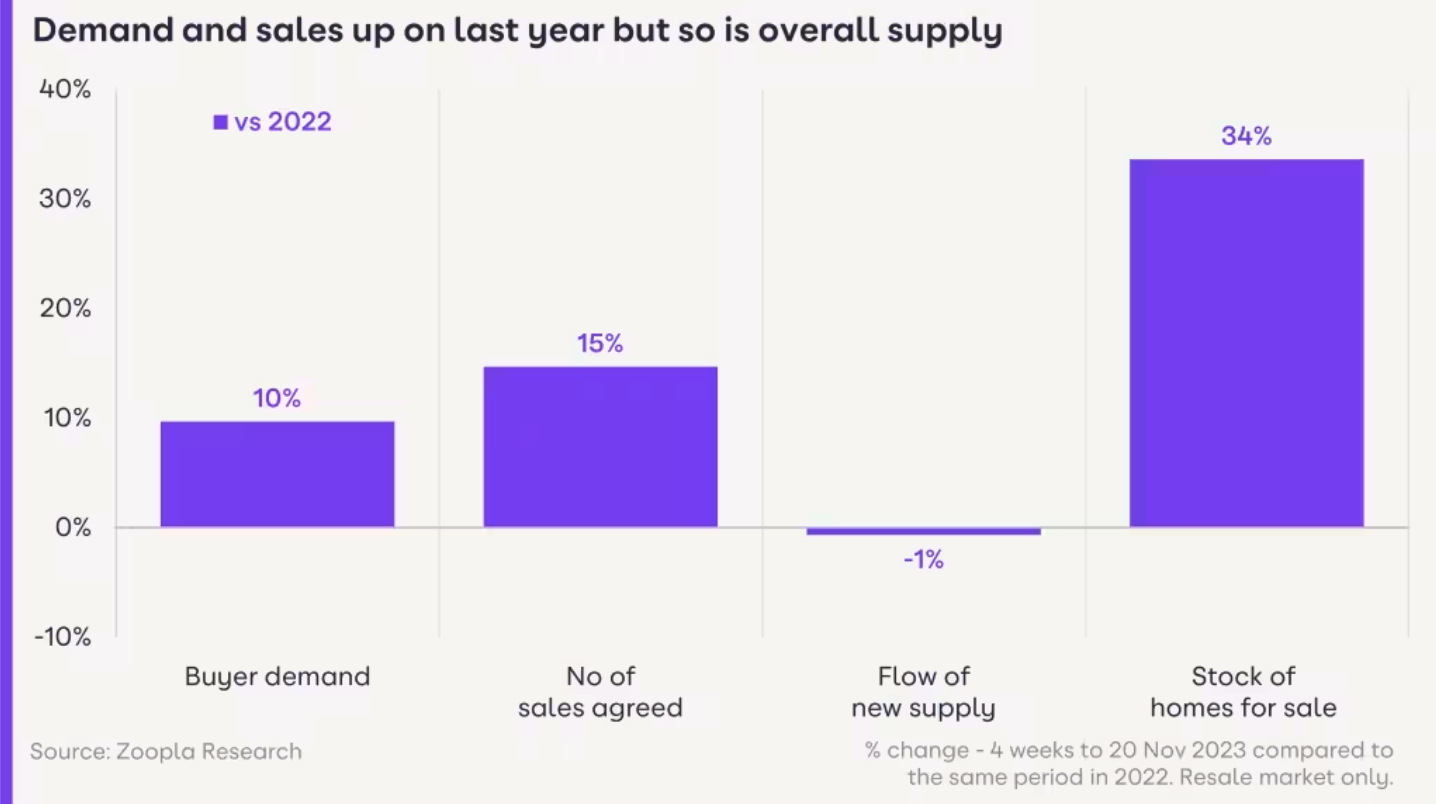

Buyer demand is 10% higher than a year ago when the mini-budget hit. But it’s low compared to normal market conditions - sitting 13% lower than in 2019.

Meanwhile, there are 15% more agreed sales than a year ago and 5% more than in 2019. This suggests more realism from sellers. They’re dropping their price expectations to agree sales with buyers, who are in a strong negotiating position.

There’s also a sense amongst buyers that mortgage rates may have peaked. This is attracting those who delayed moving in the last year.

Many parts of Scotland and inner London are seeing residential property sale numbers hold up. Market activity here has lagged behind the rest of the UK in recent years.

The pipeline of sales is the lowest for 4 years but we still expect 1 million sale completions in 2023.

UK house prices fall 1.2% with most homeowners impacted

The average house price has fallen 1.2% in the last 12 months, with all price bands and locations in England and Wales impacted.

The East of England (-2.6%), the South East (-2.4%) and London (-2.0%) are the worst hit. Northern Ireland and Scotland are least impacted, with the average house price now +1.9% and +1% higher than a year ago.

The largest price falls are in Southern England where demand is falling and supply is growing. Many of these locations saw strong demand and price growth during the pandemic ‘race for space’. The biggest price falls at a postal area level are currently -4% in Colchester (CO).

It’s important to note that property prices remain well above what they were before the pandemic, even in the places with the biggest house price falls.

The average estate agency branch now has 31 homes for sale. This was just 14 in the middle of the pandemic.

This gives much more choice to people buying a home - and arms them with negotiating power.

3 and 4+ bedroom homes have seen the biggest increase in supply across the UK. There are more for sale than before the pandemic in every UK region except Scotland, the North East and the North West.

Largest discounts to asking prices for more than 5 years

The average discount is at a 5-year high, with property sales being agreed at 5.5% lower than asking price. This has increased from 3.4% in the first half of this year.

This 5.5% discount equals £18,000, which is even more than in 2018. That was the last time housing demand and price inflation weakened.

This shows more realism among people selling their home. Sellers are accepting ever-larger discounts as greater supply puts pressure on them to attract a buyer.

What’s going to happen in the housing market in 2024?

House prices have further to fall in 2024 but it’s positive news that the number of sales agreed is holding up. It shows that willing parties are ready to move, albeit with buyers getting bigger discounts.

5-year fixed mortgage rates have been falling below 5% but they need to drop further to bring more people back to the housing market. Rising wages and falling house prices are helping affordability, but they’re not enough to offset higher mortgage rates yet.

The number of homes for sale will start to decline this month. It’s a seasonal tactic to take your home off the market for Christmas and relaunch it in the New Year when buyer demand spikes.

If you’re serious about selling your home, be sure to set your asking price realistically. It will help you attract demand and agree a sale more quickly, especially when you’re competing with many other homes for sale.

Financial markets forecast that the Bank of England will start cutting rates around summer 2024. If this causes mortgage rates to fall further, there will be an improvement in demand and sales volumes later next year. Regardless, house prices will continue to fall slightly throughout the year.